HOW TO IMPORT VEHICLE FROM THE FACTORY?

Import your dream car from Japan fctory directly. If you looking for factory order brand new customized vehicle we can help you get one directly from the car manufacture in Japan. You can purchase any Japan domestic model of Honda, Toyota, Subaru, Suzuki, Daihatsu, Mitsubishi, FUSO etc., Our factory order car prices are very reasonable, transparency and unbeatable. There is no hidden cost. Not only passenger vehicles, but we also can help you buy earth machinery, industrial machinery, and boat jet ski, etc., Please read the steps written bellow carefully and contact us if you have any questions, concerns or any further clarification.

Your money is 100% safe with us.

Your valuable money is 100% safe with us. Typically we request our customer to pay 10% of advance payment for factory order or auction bid vehicle. This is a must company regulation requirement for us to identify that the customer is genuine and seriously consider of purchase vehicle. In case if the customer decides to cancel the order after advance payment we will try our best to cancel the order and refund the full amount but in some cases, there may be some cost we request customer to pay like re-auction fee, etc.,

THINGS TO CONSIDER WHEN IMPORT

-

Find the vehicle duty, rule & regulation of import vehicle.

-

Check whether it is worth to export than purchase from locally.

-

Find the trusted exporter who has experience exporting vehicles to your country.

-

Get a detailed quote with the lead time of the shipping to your country.

-

Make sure that there is no hidden cost.

How to Import Factory order vehicle

Buyer confirm the quote

Buyer confirm quote and Buyer and seller agree on delivery schedule

Easy Cars ship the car

Easy Cars send photos of vehicle to customer and ship the vehicle

Buyer pay advance

Buyer pay the down payment to Easy Cars (20~50% of the CIF Price)

Buyer receive documents

Easy Cars prepare documents and courier to the customer

Easy cars place order

Easy Cars place the order to factory after receiving the down payment

Buyer clear from the port

Customer collects the documents and clears the vehicle from the custom

Buyer receive the quote from the Easy Cars

The buyer receives a quote from easy cars and negotiates the price.

Buyer pay dvance

Buyer pay the down payment to Easy Cars (10% of the CIF Price)

Buyer open LC or TT balance

Customer open LC or pay balance payment after receiving chassis no

Buyer receive documents

Easy Cars prepare documents and courier to the customer

Buyer confirm the quote

Buyer confirm quote and Buyer and seller agree on delivery schedule

Easy Cars place order

Easy Cars place the order to the factory

Easy Cars shipping the cars

Easy Cars send photos of vehicle to customer and ship the vehicle

Buyer clear from the port

Customer collects the documents and clears the vehicle from the custom

Buyer confirm the quote

Buyer confirm quote and Buyer and seller agree on delivery schedule

Buyer pay advance

Buyer pay the down payment to Easy Cars (10% of the CIF Price)

Easy cars place order

Easy Cars place the order to factory after receiving the down payment

Buyer open LC or TT balance

Customer open LC or pay balance payment after receiving chassis no

Easy Cars ship the car

Easy Cars send photos of vehicle to customer and ship the vehicle

Buyer receive documents

Easy Cars prepare documents and courier to the customer

Buyer clear from the port

Customer collects the documents and clears the vehicle from the custom

Browse through the vast selection of vehicles that have recently been added to our inventory.

Frequently Asked Questions About Factory Order Cars

Sort FAQ By:

Normally, no customs duties or VAT will be payable, provided you have owned the vehicle for at least 6 months, that all duties and taxes have already been paid and that you are importing the vehicle within twelve months of becoming a resident in France.

Import Tax & VAT

Import Customs : Cars 5-10%

VAT : (CIF + Import Customs) x 19.6%

Registration fee: EUR 34 per horsepower (half price for more than 10 years old cars) Eco Supercharge

You will need to complete two copies of Déclaration d’entrée en France en franchise de biens personnels en provenance de pays tiers à l’Union Européenne , which you should send to your local customs office by recorded delivery.

Here are the required documents to clear and register the vehicle in France

- Certificate of Road Worthiness – Provided by Easy Cars Japan

- Proof of Identity

You will need to produce:

your passport;

a utility bill giving proof of your address. - Insurance Certificate

- Fiscal Rating

- In order to obtain registration, you need to calculate the ‘fiscal rating’ of the vehicle as this needs to be entered on the application. This information is not on a foreign registration card, although it is possible it might be included on the certificate of conformity.

The fiscal rating of the vehicle is derived from the fiscal engine capacity of the vehicle, called the ‘puissance fiscal’ (PF), when it is then expressed as the administrative chevaux fiscaux/cheval fiscal. It is calculated using the following formula:

PF = (CO₂/45) + (P/40)^1.6.

Where:

PF = Puissance Fiscale

CO₂ = Carbon Emission (gr/km)

P = Horsepower (1 hp = 0,736 kW)

- In order to obtain registration, you need to calculate the ‘fiscal rating’ of the vehicle as this needs to be entered on the application. This information is not on a foreign registration card, although it is possible it might be included on the certificate of conformity.

- Registration Process

- Once you have all these documents, as well as your existing registration certificate, then you should complete a request for a vehicle registration document – a Demande de certificat d’immatriculation, also known by its former name of carte grise.

This process can only be undertaken online at Agence nationale des titres sécurisés via prior registration with France Connect.

- Once you have all these documents, as well as your existing registration certificate, then you should complete a request for a vehicle registration document – a Demande de certificat d’immatriculation, also known by its former name of carte grise.

Here are some guides to refer to when import vehicles to Hong kong.

These will apply when shipping a car from Japan.

Here are the required documents to clear and register the vehicle in Hong Kong

- Bill of Lading – Provided by Easy Cars Japan

- Import license – Arrange by Importer

- Commercial Invoice – Provided by Easy Cars Japan

- De-Registration Certificate Copy – Provided by Easy Cars Japan

- Proof of Emission Compliance – Provided by Easy Cars Japan

All motor vehicles registering in Hong Kong for the first time should meet the requirements of the Air Pollution Control Regulations and Noise Control Regulations.

- Application for Emission Approval

- Easy Cars Japan completes the ‘Application for Vehicle Exhaust and Noise Emissions Compliance’ form and the ‘Noise Emission Certificate General Approval’ (NECGA).

- The original documents to be attached with the form

- Certificate of Conformity (COC) issued to the vehicle by its vehicle manufacturer (for vehicles manufactured within one year from the date of application).

- Exhaust emission test report issued within 6 months by one of the recognized vehicle emission testing laboratories and noise compliance report.

The importer who applies import certificate should submit all these to the Environmental Protection Department for approval.

Here are some guides to refer to when import vehicles to Hong kong.

The first Registration and taxes

Requirement of Proof of Address

Importing an automobile into Hong Kong for personal use.

Vehicle Examination

How to import your car into Hong Kong.

To import your car to Malaysia, you must apply for an Approval Permit (AP) from the Ministry of International Trade and Industry (MITI). In order to apply for this permit, your car must be registered under your name for at least 3 years.

Documents required for AP from the MITI

- Original and photocopy of passport.

- Ownership certificate or original or photocopy of the registration document.

- Insurance or proof of minimum one-year-old under the same name as the applicant for AP.

- JK 69- AP application form.

- Original and copy of receipt/ purchase invoice for the automobiles.

The permit is valid only for 3 months. If one does not import the vehicle during that period, then have to go through the whole process again.

Documents Required for importation

- A letter of application addressed to the Ministry Of International Trade and Industry (MITI) for importing a car from your home country to Malaysia for personal use.

- A JK69 form must be purchased at MITI and duly completed.

- Documentation of car which indicates proof of ownership. Typically this will be a purchase receipt or transfer of ownership/letter from the previous owner if the car was purchased second-hand.

- The car’s original insurance documents and/or a letter from the insurance company.

- The original and photocopied registration document of the car.

- Your work permit and letter of contract from your employer in Malaysia.

- A photocopy of your passport.

- Malaysian or International driving license.

Vehicle Registration

- Identification documents

- PUSKAPOM inspection report

- Customs Form K1

- The Approved Permit for the vehicle

Import Duties For Passenger Cars (Petrol Engine):

- 1799cc or under Vehicle Engine (Cylinder) Capacity: 140% of CIF

- 1800 – 1999cc Vehicle Engine (Cylinder) Capacity: 170% of CIF

- 2000 – 2499cc Vehicle Engine (Cylinder) Capacity: 200% of CIF

- 2500 – 2999cc Vehicle Engine (Cylinder) Capacity: 250% of CIF

- 3000cc or over Vehicle Engine (Cylinder) Capacity: 300% of CIF

For diesel engines, the import duty has been set as 120 percent of CIF.

Import Duties For 4×4 vehicles and others:

- 1799cc or under Vehicle Engine (Cylinder) Capacity: 60% of CIF

- 1800 – 1999cc Vehicle Engine (Cylinder) Capacity: 80% of CIF

- 2000 – 2499cc Vehicle Engine (Cylinder) Capacity: 150% of CIF

- 2500 – 2999cc Vehicle Engine (Cylinder) Capacity: 180% of CIF

- 3000cc or over Vehicle Engine (Cylinder) Capacity: 200% of CIF

- Customers need to pay 10% of the CIF price When you confirm the order

- Lead Solution place the order after receiving down payment

- Factory send chassis number of vehicle one week before they deliver the vehicle to Lead Solution warehouse

- Customers need to pay balance payment after receiving chassis no

- Lead Solution ship vehicle to Singapore

- Lead Solution prepare documents and send a copy to customer for confirmation

- Once confirmed, the Original will be courier to the customer’s address.

- Customer clear vehicle from custom

- Deal Done!

- Matters of Registration Certificate – Current Record ( Originals and English translation)

- Preserve Records Certificate ( Originals and English translation)

- Export with De-registration certificate (Originals and English translation)

- Factory/Supplier Invoice – English

- Bill of Lading/Arrival Notice – English

- Insurance Policy – English

- Vehicle Specification – English

- Impressive photo portfolio which helps you to sell the car before it’s even arrived.

- Bill of lading

- Freight and insurance invoices

- Bills/receipts relating to incidental charges incurred during shipment

- Full manufacturer’s specification card (a listing of standard and optional equipment on the vehicle and unique for every vehicle)

- Completion Inspection Certificate (CIC) Paper

- Registration/De-registration documents from the country of exportation

- Manufacturer’s letter confirming the date of vehicle’s manufacture

- Payment documents for the purchase (for example, telegraphic transfer slip)

- Clear photos of the odometer (showing mileage), interior, exterior, and engine/chassis number (for used vehicles)

- Once the application is approved, an approval letter from Singapore Customs containing details of the vehicle, such as unit price and incoterms, will be sent to the importer.

FOB (Free On Board): Term of sale under which the price invoiced or quoted by a seller includes all charges up to placing the goods on board a ship at the port of departure specified by the buyer. Also called collect freight, freight collect, or freight forward

CIF (Cost, Insurance & Freight): Term of sale signifying that the price invoiced or quoted by a seller includes insurance and all other charges up to the named port of destination. In comparison, carriage and insurance paid to (CIP) terms include insurance and all charges up to a named place in the country of destination (usually the buyer’s warehouse). See also cost and freight (C&F, or CFR). The difference between CIF and CFR is insurance during the transportation

The major difference between CIF and FOB is the transportation costs and insurance during it.

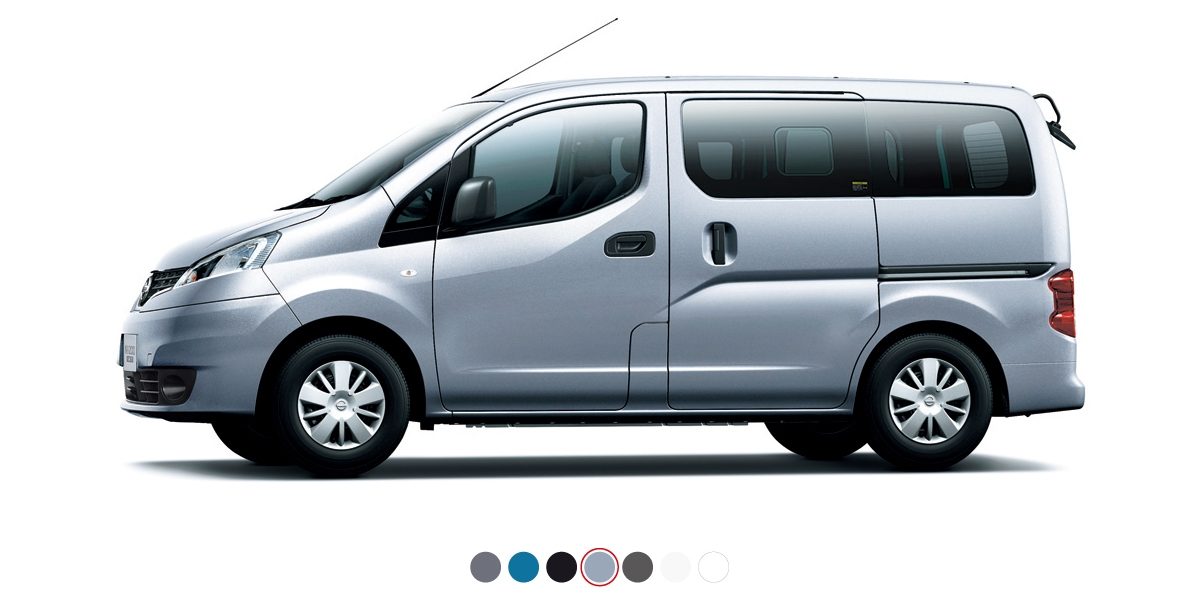

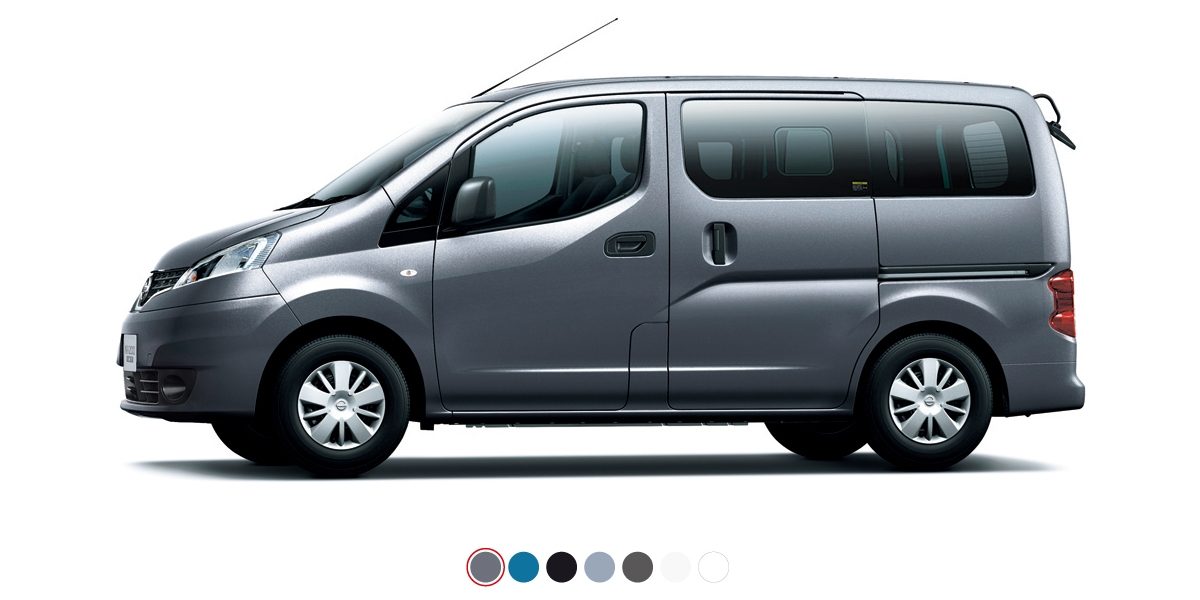

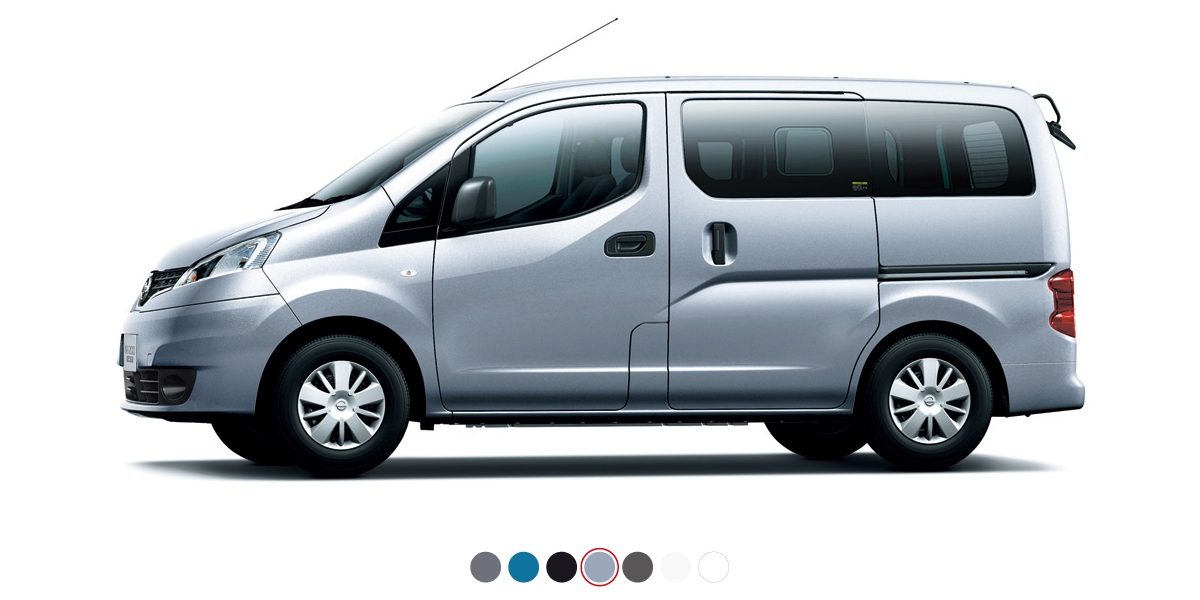

If your order is very specific, with a particular color, grade, body kits, and accessories or extras, your car will take a little longer to get ready. If you need your car sooner, you can ask whether the sales agent can find the brand new vehicle in the auction.

To help expedite your order, the agent may suggest changes such as a different color or a slightly used one from the auction.

We always make sure that both parties benefit from the relationship. We want our customers to be happy so they not only come back for more of our services but also tell their friends and relationships to do business with you. This is the true success of our business.

- Export Certificate

- Bill of Lading

- Final Invoice (Proforma Invoice)

- Shipping / Marine Insurance (if required)

- Any other special documents (if required)

- Inspection Certificate from Japan Auto Appraisal Institute (JAAI) / Japan Vehicle Inspection Association (JEVIC) and other inspections (if required)

The brand new vehicle from the dealers is registered in Japan. Exporter has to de-register the vehicle before it

ship to you. Because of this regulation, the brand new cars we export are already been registered in Japan but never used.

We always make sure that both parties benefit from the relationship. We want our customers to be happy so they not only come back for more of our services but also tell their friends and relationships to do business with you. This is the true success of our business.

Some Highlights Of Factory Order Service

Customizable Factory Orders

All factory order vehicles are highly customizable based on the colors and options are available with the manufacturer. We can even help you further customize your vehicle using third party body kits and car accessories. we don’t keep any margin for the parts and accessories from the customer who purchase the vehicle. You need to pay 10% of downpayment before we place order to factory.

Fast & Secure Delivery

All our prices are set with fasterest delivery. We know that customers are eager to receive their vehicle after purchase. We always select fasters route where it is available. Also our vehicles are covers with comprehensive shipping insurance which covers any issues when ship deliver vehicle from our yard to customer’s hand

Your money is 100% safe

Your money is 100% secure with us. We are company registered under Japanese law and value world famous honest Japanese business-standard. We are customer oriented company in the business for several years. Together, our customers have saved a fortune by business with Easy Cars avoiding unwanted charges due to high charge agents, hidden fees, and broken promises.