Frequesntly Asked Questions asked by Our Customers

Please find below some of the Frequently Asked Questions asked by our customers relating to our service of exporting cars from Japan and how our export cars and sparepart service works. Click each tab and then questions reveal the answers. If you still have questions, please do not hestitate to reacy us by phone or email. You can find our contacts Contact Us

Sort FAQ By:

Sort FAQ By:

We provide all documents which you required to clear your vehicle from the port and register the vehicle with the road authority in Singapore. We typically provide the following documents. If you need anything additional, please let us know. we will provide all documents without additional charge.

- Matters of Registration Certificate – Current Record ( Originals and English translation)Preserve Records Certificate ( Originals and English translation)

- Export with De-registration certificate (Originals and English translation)

- Factory/Supplier Invoice – English

- Bill of Lading/Arrival Notice – English

- Insurance Policy – English

- Vehicle Specification – English

After confirmation of the payment or upon receiving the LC, Easy Cars Japan will start your car shipment process. Easy cars in Japan will dispatch the required documents through courier services. For non-LC buyers, the document will be dispatched only after payment received from our bank. The following documents are includes. We can provide the other documents on a request basis if required.

- Export Certificate

- Bill Of Lading

- Final Invoice

- Shipping / Marine Insurance (if required)

- Bill Of Lading

- Inspection Certificate from Japan Auto Appraisal Institute (JAAI) / Japan Vehicle Inspection Association (JEVIC) and other inspections (if required)

Sort FAQ By:

EMS: Delivery will be made in approximately 2 – 4 days.

Airmail: Delivery will be made in approximately 4 – 6 days.

Economy Air (SAL): It transports items by air at a lower priority than airmail. The service is faster than surface mail while the cost is lower than airmail. SAL is only available for a limited number of countries and territories.

Surface Mail: Sent by surface. While delivery takes 1 to 3 months, the rates are reasonable.

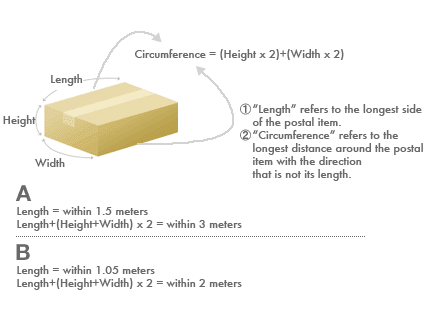

Dimension: 1.5 meters (The most front spoilers are over this dimension hence can be shipped via special sea shipping)

Weight: Maximum up to 30 kg

The maximum weight may be different for some countries/areas.

For details, please contact us

Sort FAQ By:

Sort FAQ By:

These will apply when shipping a car from Japan.

Here are the required documents to clear and register the vehicle in Hong Kong

- Bill of Lading – Provided by Easy Cars Japan

- Import license – Arrange by Importer

- Commercial Invoice – Provided by Easy Cars Japan

- De-Registration Certificate Copy – Provided by Easy Cars Japan

- Proof of Emission Compliance – Provided by Easy Cars Japan

All motor vehicles registering in Hong Kong for the first time should meet the requirements of the Air Pollution Control Regulations and Noise Control Regulations.

- Application for Emission Approval

- Easy Cars Japan completes the ‘Application for Vehicle Exhaust and Noise Emissions Compliance’ form and the ‘Noise Emission Certificate General Approval’ (NECGA).

- The original documents to be attached with the form

- Certificate of Conformity (COC) issued to the vehicle by its vehicle manufacturer (for vehicles manufactured within one year from the date of application).

- Exhaust emission test report issued within 6 months by one of the recognized vehicle emission testing laboratories and noise compliance report.

The importer who applies import certificate should submit all these to the Environmental Protection Department for approval.

Here are some guides to refer to when import vehicles to Hong kong.

The first Registration and taxes

Requirement of Proof of Address

Importing an automobile into Hong Kong for personal use.

Vehicle Examination

How to import your car into Hong Kong.

Normally, no customs duties or VAT will be payable, provided you have owned the vehicle for at least 6 months, that all duties and taxes have already been paid and that you are importing the vehicle within twelve months of becoming a resident in France.

Import Tax & VAT

Import Customs : Cars 5-10%

VAT : (CIF + Import Customs) x 19.6%

Registration fee: EUR 34 per horsepower (half price for more than 10 years old cars) Eco Supercharge

You will need to complete two copies of Déclaration d’entrée en France en franchise de biens personnels en provenance de pays tiers à l’Union Européenne , which you should send to your local customs office by recorded delivery.

Here are the required documents to clear and register the vehicle in France

- Certificate of Road Worthiness – Provided by Easy Cars Japan

- Proof of Identity

You will need to produce:

your passport;

a utility bill giving proof of your address. - Insurance Certificate

- Fiscal Rating

- In order to obtain registration, you need to calculate the ‘fiscal rating’ of the vehicle as this needs to be entered on the application. This information is not on a foreign registration card, although it is possible it might be included on the certificate of conformity.

The fiscal rating of the vehicle is derived from the fiscal engine capacity of the vehicle, called the ‘puissance fiscal’ (PF), when it is then expressed as the administrative chevaux fiscaux/cheval fiscal. It is calculated using the following formula:

PF = (CO₂/45) + (P/40)^1.6.

Where:

PF = Puissance Fiscale

CO₂ = Carbon Emission (gr/km)

P = Horsepower (1 hp = 0,736 kW)

- In order to obtain registration, you need to calculate the ‘fiscal rating’ of the vehicle as this needs to be entered on the application. This information is not on a foreign registration card, although it is possible it might be included on the certificate of conformity.

- Registration Process

- Once you have all these documents, as well as your existing registration certificate, then you should complete a request for a vehicle registration document – a Demande de certificat d’immatriculation, also known by its former name of carte grise.

This process can only be undertaken online at Agence nationale des titres sécurisés via prior registration with France Connect.

- Once you have all these documents, as well as your existing registration certificate, then you should complete a request for a vehicle registration document – a Demande de certificat d’immatriculation, also known by its former name of carte grise.

Here are some guides to refer to when import vehicles to Hong kong.

- Bill of entry (in duplicate)

- Invoice/Receipts

- Bill of Lading

- Packing List/ List of goods in cargo

- Copy of passport of a most recent entry in Seychelles

- Copy of passport of an exit of 12 months or more from Seychelles

- Import permit

- Letter from the organization to certify that the student/graduate was sent for studies or in cases whereby the student/graduate went to study at their own expense, they must provide document(s) proving their attended institution of study. (If applicable) i) Prove ownership of the vehicle.

- Copy of driving license

a) Cylinder capacity not exceeding 1,600cc = 10%b) Cylinder capacity exceeding 1,600cc but not exceeding 2,000cc = 15%c) Cylinder capacity exceeding 2,000cc but not exceeding 2,500cc = 20%d) Cylinder capacity exceeding 2,500cc = 25%

a) A flat rate of 10% of Excise Tax is being proposed to be applicable to Plugin Hybrids

Motor Vehicles designed for Transport of Goods, given that they are classified by tonnage rather than by cylinder capacity.

b) A similar flat rate of 10% is also being proposed for Plugin Hybrids Motorcycles, given the negligible level of trade in Plugin hybrid motorcycles. All these changes will be applicable from April 2018.

1. The motor vehicle must not be older than 3 years.2. The motor vehicle must be for passenger use only, classified under HS Code 8703 and motorcycle HS Code 8711.3. A returning resident may import used motorcycle on condition that it is not older than 3 years at the time of landing in Seychelles.4. The motor vehicle must be imported ( i.e. landed in Seychelles) no later than 6 months from the first day of returning resident’s arrival in Seychelles.5. Once imported into the country, the motor vehicle or motorcycle shall be registered in importer’s name and it shall be permitted to be sold or transferred for a period of two years following registration at SLA.6. Only one motor vehicle or motorcycle shall be permitted per person and her/he must be 18 years and above.7. The motor vehicle should be Right-Hand drive.8. A returning resident once granted an import permit will not be allowed to import another second-hand motor vehicle or motorcycle should he/she decide to move overseas again.9. Should the importation fail to meet this policy, Customs Division reserves the right to dispose of the motor vehicle or motorcycle as prescribed under the Revenue Law.

1. The motor vehicle must not be older than 3 years2. The motor vehicle must be for passenger use only, classified under HS Code 8703 and motorcycle HS Code 8711.3. A returning graduate may import used motorcycle on condition that it is not older than 3 years at the time of landing in Seychelles.4. The motor vehicle or motorcycle must be imported no later than 6 months from the first day of the returning graduate’s arrival in Seychelles.5. Once imported into the country, the motor vehicle or motorcycle shall be registered in importer’s name and it shall not be permitted to be sold or transferred for a period of two years following registration at SLA.6. Only one motor vehicle or motorcycle shall be permitted per person and her/he must be 18 years and above.7. The motor vehicle should be Right-Hand drive.8. A returning graduate once granted an import permit will not be allowed to import another second-hand motor vehicle or motorcycle should he/she decide to move overseas again.9. Should the importation fail to meet this policy, Customs Division reserves the right to dispose of the motor vehicle or motorcycle as prescribed under the Revenue Law.

- Customer need to pay 10% of the CIF price When you confirm the order

- Easy Cars place the order after receiving a down payment

- Factory send chassis number of vehicle one week before they deliver the vehicle to Easy Cars warehouse

- Customer need to pay balance payment after receiving chassis no

- Easy Cars ship vehicle to Singapore

- Easy Cars prepare documents and send a copy to the customer for confirmation

- Once confirmed, the Original will courier to the customer’s address.

- Customer clear vehicle from custom

- Deal Done!

- Matters of Registration Certificate – Current Record ( Originals and English translation)

- Preserve Records Certificate ( Originals and English translation)

- Export with De-registration certificate (Originals and English translation)

- Factory/Supplier Invoice – English

- Bill of Lading/Arrival Notice – English

- Insurance Policy – English

- Vehicle Specification – English

- Impressive photo portfolio which helps you to sell the car before it’s even arrived.

- Bill of lading

- Freight and insurance invoices

- Bills/receipts relating to incidental charges incurred during shipment

- Full manufacturer’s specification card (a listing of standard and optional equipment on the vehicle and unique for every vehicle)

- Completion Inspection Certificate (CIC) Paper

- Registration/De-registration documents from the country of exportation

- Manufacturer’s letter confirming the date of vehicle’s manufacture

- Payment documents for the purchase (for example, telegraphic transfer slip)

- Clear photos of the odometer (showing mileage), interior, exterior, and engine/chassis number (for used vehicles)

- Once the application is approved, an approval letter from Singapore Customs containing details of the vehicle, such as unit price and incoterms, will be sent to the importer.

There are several steps to import a used vehicle in Australia :

- Obtain a Vehicle Import Approval (VIA) from the Vehicle Safety Standards Branch of the Department of Infrastructure, Transport, Regional Development, and Local Government.

- Pay customs duty, Goods and Services Tax (GST) and luxury car tax (LCT) where applicable and obtain customs clearance at the port of entry.

- Obtain quarantine clearance from the Australian Quarantine and Inspection Service (AQIS) after the road vehicle has arrived at the port of entry.

- To gain Customs clearance for an imported road vehicle you must hold a valid VIA for that road vehicle.

- It is an offense under the MVSA to import, sell or present new or used imported road vehicles to the Australian market for the first time unless those road vehicles meet the National Standards.

- If your road vehicle has a value below the import entry threshold (AUD1000) it may be cleared by Customs by lodging a self-assessed clearance (SAC) declaration. A VIA is required regardless of the value of the road vehicle.

- Get a quote for shipping / customs clearance / quarantine / packing / depot / terminal handling fees / cleaning fees / duties / taxes.

Purchase the car in a controlled manner, via an agent, or by a letter of credit through your bank. The risks involved with the loss of money is dependant on the relationship you have with the seller. - Make sure all documents are given to a customs broker in your port, or you can have a go at clearing yourself. Mistakes are costly and storage isn’t cheap, so using a broker is a smart move.

- They have methods of valuing the car less than what you expect to save on duties (usually 10 percent) and GST 10 percent. Also, high price vehicles may attract luxury car tax.

- Delivery of your road vehicle into home consumption will only be authorized where Customs and AQIS clearance requirements are met.

https://infrastructure.gov.au/vehicles/imports/process_overview.aspx

Import vehicle to Indonesia

It is possible to import brand new cars to Indonesia, but there are many restrictions and it is very expensive. The government levies a 300% duty on the value of the vehicle. Used cars cannot be imported exceptions may be made for the people who are on an extended diplomatic mission.

Required Documents For Shipping A Vehicle To Indonesia :

- Title & Registration – must be originals. – EasyCars Japan can be provided

- Bill of lading (either ocean or air) – EasyCars Japan can be provided

- Packing list – EasyCars Japan can be provided

- Copy of passport – Importer need to prepared

- Work permit – Importer need to prepared

- Form PP-8 (for diplomats) – Importer need to prepared

Shipping destinations (Ports) in Indonesia

Sort FAQ By:

For Example. We charge JPY 110,000 for purchase and ship Wagon R type vehicle to Sri Lanka.

Browse through the vast selection of vehicles that have recently been added to our inventory.

Recent Comments